There are affiliate links on this page.

Read our disclosure policy to learn more.

Translate this page to any language by choosing a language in the box below.

Fake Refund Email from the Internal Revenue Service

Scam Phone Calls Impersonating the Treasure Department and IRS

Example from 352-366-4670

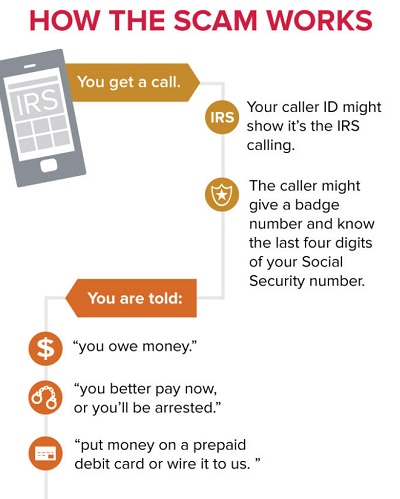

Have you received an phone call from a recorded voice, saying there is a legal action taken against you by the ITreasury Department or the IRS?

It is a scam. The US TReasury Department and IRS will never, never call you unless you first contact them. They also WILL NOT EVER email you to tell you you owe money or are due to receive a refund; or for any other reason. Count on it.

There are many scammers imprsonating the Treasury Department and the IRS calling consumers right now. One number they are using is 352-366-4670 in Groveland, Florida.

Typically, the caler or recording claims to be employees of the IRS or the US Treasury Department. The recording urges you to call them nback on 352-366-4670.

If you do, you are told you owe money to the IRS and it must be paid promptly through a pre-loaded debit card or wire transfer. You may be threatened with arrest, deportation or suspension of a business or driver's license. In many cases, the caller becomes hostile and insulting. Or,you may be told you have a refund due to try to trick you into sharing private information. If the phone isn't answered, the scammers often leave an "urgent" callback request.

How do you know this is a scam?

The IRS reminds us that the government will never:

- Call to demand immediate payment using a specific payment method such as a prepaid debit card, gift card or wire transfer. Generally, the IRS will first mail you a bill if you owe any taxes.

- Threaten to immediately bring in local police or other law-enforcement groups to have you arrested for not paying.

- Demand that you pay taxes without giving you the opportunity to question or appeal the amount they say you owe.

- Ask for credit or debit card numbers over the phone.

- Soliciting Form W-2 information from payroll and human

Recommendations:

If you receive a call from this number or any group that claims to represent a government agency, take down their information, including the contact's name, phone number, etc. Do NOT give them any personal or financial information, especially not a credit card, checking or bank account number, passport number, etc.

Next, look up the direct phone or email address for the agency they claim to represent and call them. Read them the email and ask if it could have come from their agency.

While we don't want to encourage people to ignore correspondence from legal government agencies, it is a safe bet that NO U.S. government agency will make any first contact with you by email. Certainly not the FBI or IRS.

If you receive an unsolicited e-mail purporting to be from the IRS, take the following steps:

-

Do not open any attachments to the e-mail, in case they contain malicious code that will infect your computer.

-

Contact the IRS at 1-800-829-1040 to determine whether the IRS is trying to contact you about a tax refund.

And please let us know about any suspicious calls or emails you receive. We look for patterns so that we can alert the authorities and victims to new scams, before it is too late!

Specific Steps to take

- Do not answer calls from restricted numbers, known

number, blocked numbers and numbers you do not recognize

If you do answer, do not press a number to opt out. That will merely verify that yours is a working number and make you a target for more calls. - Sign up with the National Do Not Call Registry.

If your number is on the registry and you do get unwanted calls, you can report them. - Use a blocking app

You can download an app like as Truecaller (free), TrapCall ($4 - $24 a month), RoboKiller, Mr. Number, Nomorobo and Hiya, which will block the calls.

YouMail goes farther, and will stop your phone from ringing with calls from suspected robocallers and deliver a message that your number is out of service.

Your cell phone service provider (T-Mobile, Verizon, AT&T, Sprint, etc.) , also have tools to combat robocalls before they reach your phone. But obviously they are not that effective. - Use a service that can harrass the scammers!

The Jolly Roger Telephone Company turns the tables on telemarketers, using speech recognition to keep the scammer on the line and wasting their time with a robotic answering service. The robots keeps the scammer on the line with respobses like "Uh-huh" and "O.K., O.K." ask the scammer to repeat their sales pitch from the beginning - Don't say "Yes" while on a call with a scammer

Some scammers get you to say the word "yes" by asking something like "Can you hear me?" and later using a recording oft that o approvecharges on the your credit card account.

&

Reporting, in the United States::

If you get a phone call from someone claiming to be from the IRS and asking for money, here's what you should do:

-

If you know you owe taxes or think you might owe, call the IRS at 1.800.829.1040. The IRS workers can help you with a payment issue.

-

If you know you don't owe taxes or have no reason to believe that you do, report the incident to the Treasury Inspector General for Tax Administration (TIGTA) at 1.800.366.4484 or at www.tigta.gov .

Report the Scam

If you get a

call from a government imposter, file a complaint at

ftc.gov/complaint. Be sure to include:

-

date and time of the call

-

name of the government agency the imposter used

-

what they tell you, including the amount of money and the payment method they ask for

-

phone number of the caller; although scammers may use technology to create a fake number or spoof a real one, law enforcement agents may be able to track that number to identify the caller

-

any other details from the call

You can also contact

U.S. Secret ServicePhone: (202) 435-5850Fax: (202) 435-5031Or contact the local U.S. Secret Service Field Office.

Financial Crimes Divisionbr> 1800 G Street, NW

Room 942

Washington, DC 20223

Frequently Asked Questions - 1.13 IRS Procedures: Reporting Fraud

How to Report Abusive Tax Promotions and/or Promoters:

Complete the

referral form which documents the information necessary to report an

abusive tax avoidance scheme. The form can be mailed or faxed to the IRS address

and fax number on the form.

How to Report Abusive CPAs, Attorneys or Enrolled Agents:

Report suspicious actions by tax professionals to the

email address of the IRS Office of

Professional Responsibility.

Overseas

Contact the Foreign Commercial Service (FSC) at the nearest U.S. Embassy or Consulate. If there is no FCS office, contact the American Citizens Services Unit of the Consular Section or the Regional Security Office.

For a comprehensive list of national and international agencies to report scams, see this page.

***